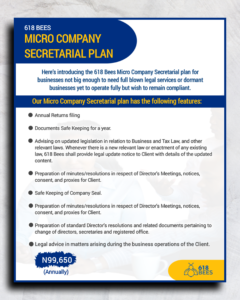

618 Bees Micro Company Secretarial Plan

Here’s introducing the 618 Bees Micro Company Secretarial plan for businesses not big enough to need full blown legal services or dormant businesses yet to operate fully but wish to remain compliant.

Our Micro Company Secretarial plan has the following features:

- Annual Returns filing

- Documents Safe Keeping for a year.

- Advise on update legislation in relation to Business Law and Tax Law, and other relevant laws.

- Preparation of resolutions in respect of Director’s Meetings, notices and consent.

- Safe Keeping of Company Seal.

- Preparation of resolutions in respect of Director’s Meetings, notices and consent

- Preparation of standard Director’s resolutions and related documents pertaining to corporate changes.

- Legal advice in one (1) matter arising during business operation of Client.

Fee: N99, 650